The reflation trade says that because of the massive debt incurred by the US Government that the value of the dollar will weaken substantially over time. Since stocks represent actual "things" they will get more valuable as the value of the dollar decreases along with commodities like Gold, Oil, Coffee, Frozen Concentrated Orange Juice, etc.

The "thing" that the Fed wanted to prevent in the midst of the credit crisis was deflation, this would be a disaster for the economy. Home prices and the prices of all other asset classes would decline and worst of all the debt incurred to pay for those rapidly shrinking assets would be more in nominal dollars. To combat this the Fed rolled out 7 trillion in aid and backstops giving us a "shadow" government and an alphabet soup of Federal Programs: TARP, TALF, Cash for clunkers, etc. This all lead to a fear of inflation and a rise of oil to $70/bbl, gold to just under $1000/oz, and a stock market up from 666 to 900.

To make the jump from 900 to 1000+ the stock market needed more fuel and got it in the form of earnings season. First the banks showed an amazing ability to make money when they could mark their bad assets at the price they paid for them and collect 11% interest on money they borrowed for free. Throw in some one time asset sales and the banks had a fantastic quarter. Next was the Fortune 500 companies, their earnings looked all the same. Top line revenue down about 25% but due to aggressive cost cutting there was a good profit on the bottom line. This was the fuel to take the market up some more.

Here is the problem with the runup...it counts on inflation in the next 6 to 12 months unfortunately for Uncle Sam I just don't see it. Right now we are in a deflationary spiral and as odd as this sounds unless the Federal Government finds a way to spend money somewhat efficiently in the "real" economy increasing the money supply it will be deflation city. Right now all of the money that the Fed has borrowed is just sitting there as a backstop to banks as loss reserves. This means when a foreclosed house gets written off (x100,000) the federal government will step in and bail the bank out allowing the bank to stay solvent and effectively transferring the debt from the private sector to the public sector.

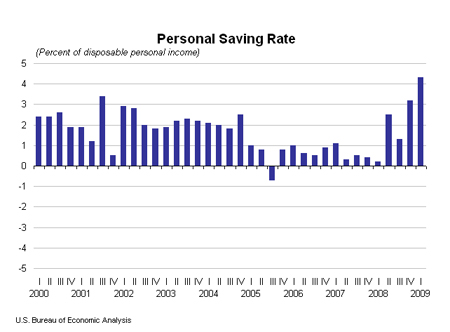

The Government has not/cannot borrow enough money to put the entire private sector debt onto it's books, it is only putting a very small fraction of it. In the meantime the consumer will continue to tighen his/her belt by deleveraging. This is a little confusing so pay attention. When you or I do not spend (consume) with our money it is by defination "saving". Now this savings didn't go into a christmas account, cd's, or money market account it went to pay down their debts.

We are now a year into the beat deflation experiment and we are starting to get tangible results in. With the enormous amount of borrowing being done at the Federal level surely inflation must be starting to rear it's ugly head.... Not so much.

Today Housing starts came out and they were at 581k a decrease from last months 587k and more importantly the Producer Price Index came in at -1% meaning the cost of doing business actually went down by 1%. Couple this with an industrial output running at 69% of capacity and 10% unemployment and it seems deflation has the wind at it's back.

This is bad, bad, bad for the market. Stocks are trading for absurd P/E levels because inflation is "baked" into the price, everybody (banks included) just had a one off quarter and will be hard pressed to repeat, and global consumer demand is down. I am not saying stocks will go down, I just don't see the catalyst to take us higher and in all likelyhood we will test the lows sometime soon.

It seems we have a choice as a country now... live in a deflationary enviroment or bypass the traditional fractional reserve banking system and make direct cash injections into the economy which will absolutely cause inflation. The clock is ticking.

No comments:

Post a Comment