It should be no surprise that after the shock of this last fall that we are starting to see businesses pick up the pieces and some of the strong ones are starting to prosper. We can see this in the ISM Chicago Index which shows the pace of business picking up.

Between the business climate warming and housing bottoming out old "Uncle Buck" has risen from his deathbed and started to do a jig. The Stronger dollar is taking it's toll on oil prices, demand is still slack and since it's priced in dollars the stronger the dollar gets the cheaper ALL commodities get. This sounds like a healthy enviroment to me.

It is also deflationary, all the money the Fed has cranked up has gone to transfer the balances of troubled banks (bad mortgages, car loans and credit cards which is the American Consumer) onto the Federal Balance sheets. This has not expanded the money supply nor has the first tranche of the Federal Stimulus as any increase in spending by the Federal Government was met with reductions in spending from the States, a zero sum game.

So excess production capacity, high unemployment, low commodity costs and an unwillingness by banks to lend because they have to keep capital on hand to cover losses. If just left alone the economy would come roaring back, sadly that isn't going to happen.

The Fed needs inflation for (2) reasons: First, and this is paramount inflation is the exact same thing as devalued dollars. The same dollar buys less goods and services. Deflation is terrible for people/country in debt. Second, Inflation makes the banking institutions magically solvent. Infaltion would drive up housing prices making home owners "above water" and creating a market where homeowners can and will sell their houses instead of walking away from hopeless mortgages.

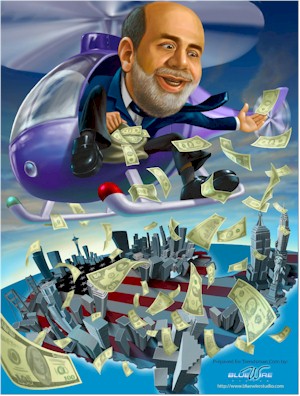

If the Fed lets its liquidity programs just "go away" they will still have to pay down the National Debt and high taxes will crush any recovery a crappy solution but much better than defaulting on our loans. If they find a way to "inject" liquidity into the consumer we get inflation, low tax rates, high interest rates, and high commodity prices.

Ben just give me a heads up on which poison you are going to choose.

No comments:

Post a Comment